January 13, 2023 | Industry News

January 2023 Regional Market Report News

Crop Updates

Anchovies

As reported in the December Bulletin, the quantities of fish caught in Peruvian waters during the last few months of 2022 were significantly reduced due to La Niña conditions causing temperatures to drop. However, as South American Summer has arrived (Dec - Feb) we have received positive news from our suppliers that catching has resumed.

We anticipate production to resume in January and February, with a full recovery projected for the category by Summer 2023. While anchovy stock is on the mend, the market will still be in shortage and we do anticipate pricing pressure.

Cooking Wines

Stock levels have been replenished for the cooking wine category in foodservice sizing. We anticipate recovery by mid-January. Roland Foods continues to work with our partners to secure supply moving forward.

Baby Corn

Thailand's baby corn harvest was heavily impacted by severe flooding in 2022. However, Roland Foods is dual sourced with access to supply in Vietnam as well as Thailand, and we are well stocked in the category to cover customer demand.

Global Supply Chain and Logistics Updates

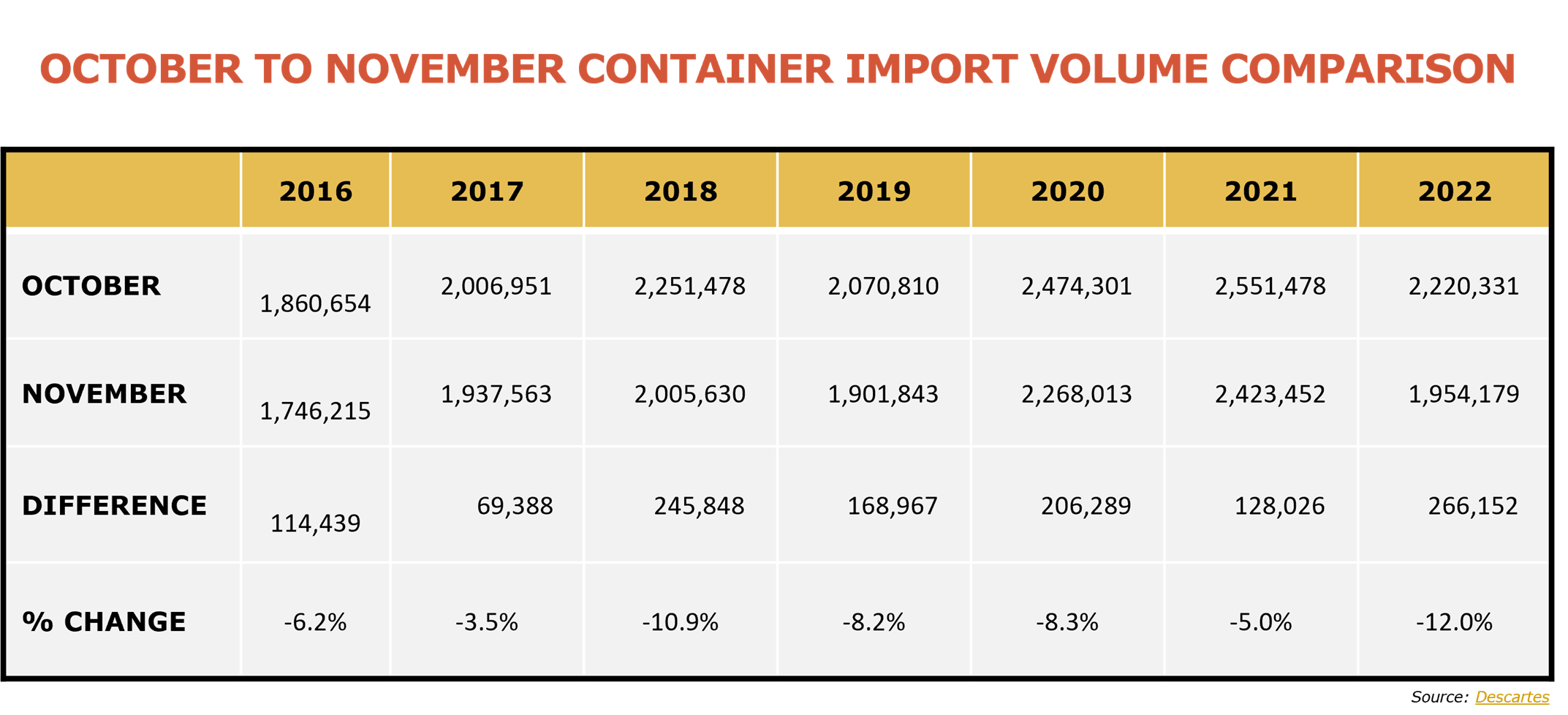

November 2023 U.S. Container Imports Near Pre-Pandemic Volume

U.S container import data for November 2022 shows a steep drop in imports and we are interpreting this as a signaling there will be a return to pre-pandemic import levels in Q1 2023.

For reference, compared to October 2022, imports declined by 12% and compared to November 2021 imports are down 19.4%. With this type of drop in volume, it is hopeful terminals and rail yards can make meaningful progress to alleviate the congestion that has been impacting our domestic supply chain for more than two years.

At Roland Foods, we’re optimistic that this trend toward normalcy will have a positive impact on our customer service throughout 2023.

Expectations for 2023

December forecasts are anticipating import volumes to be slightly higher than November. Strong consumer spending during the holiday season and preparation for China’s annual Lunar New Year factory closings prompt shippers to place more orders in the short term. Still, we are not expecting another sustained shipping boom. Our shipping line partners remain unsure of how strong global shipping demand will be post-Chinese New Year.

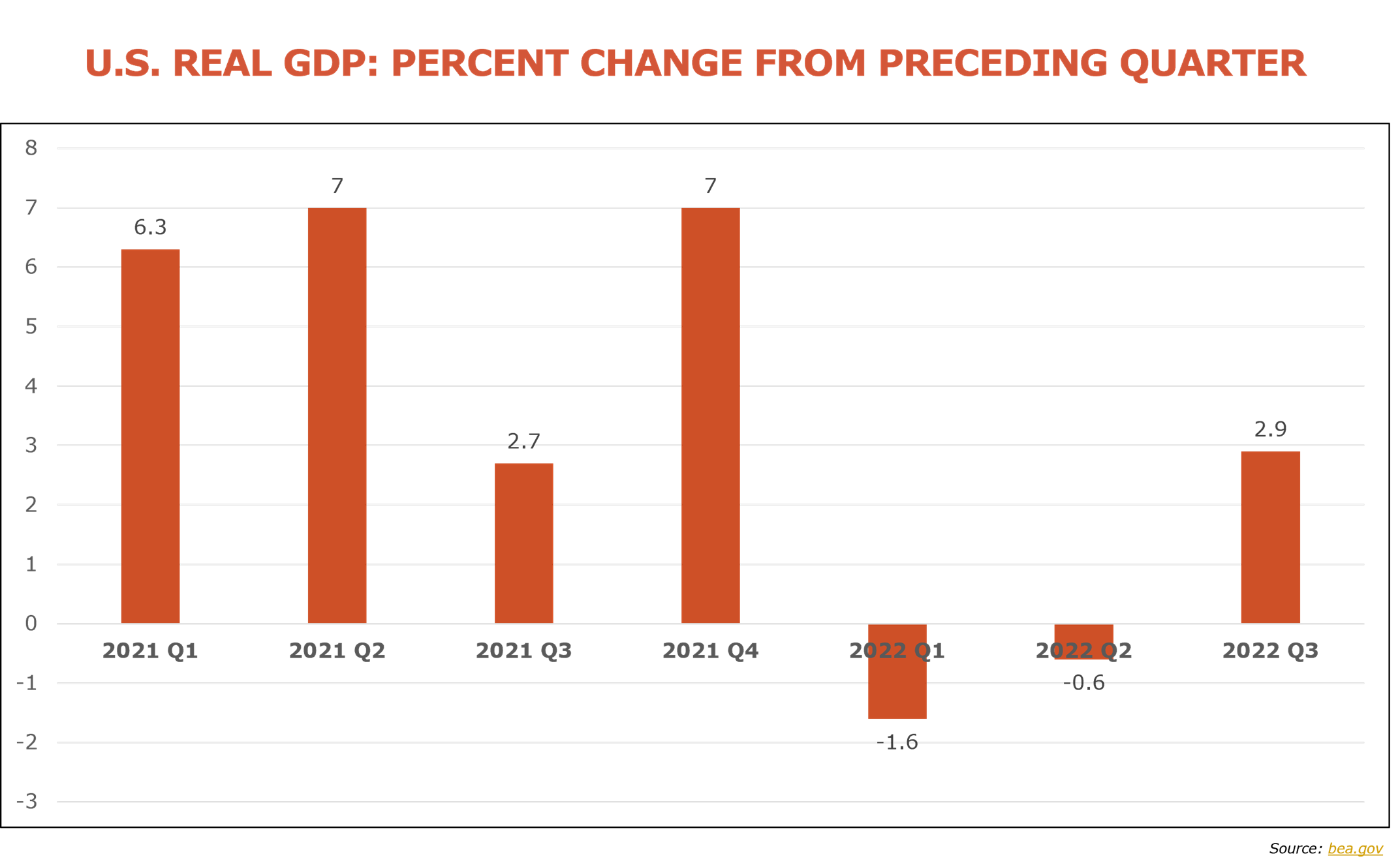

The macroeconomic situation has several conditions to consider. Key metrics show some optimism as the U.S economy grew in Q3, employment increased, and inflation eased. On the contrary, the reopening of the Chinese economy brings with it uncertainty. How the Chinese government will control future outbreak is unclear, and with that, the effects on Chinese society and business remain unknown. Inflation is still a global issue, and a fully operating Chinese economy could raise oil demand and further inflate energy prices.

At Roland Foods, we will continue to monitor the global economy to ensure we are poised for success, exercising our competitive advantage of supplying quality products in any environment.